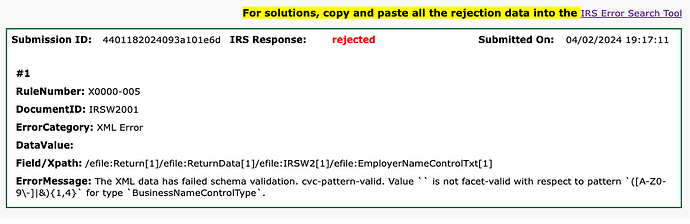

This year I used the Free File Fillable Forms service to do my taxes. It’s pretty slick if you know your way around a tax form. That said, I just got this error emailed to me about my filing, which has been rejected until I fix the problem:

Issue : Business Rule X0000-005 - The XML data has failed schema validation. cvc-pattern-valid. Value `` is not facet-valid with respect to pattern

([A-Z0-9\-]|&){1,4}for typeBusinessNameControlType.The following information may help you determine the form at issue:

Field/Xpath: /efile:Return[1]/efile:ReturnData[1]/efile:IRSW2[1]/efile:EmployerNameControlTxt[1]

This is an error only a programmer could love tollerate. XML stands for Extensible Markup Language, which is superset of HTML. So the service uses that file format to store tax form data.

The error is Business Rule X0000-005, which means nothing to everyone except programmers who have the source code. Slightly more helpful (to programmers) is the cartoon swear ([A-Z0-9\-]|&){1,4}. It’s a regular expression that matches if the input string is a series of 1 to 4 letters, numbers, dashes or ampersands. Since my input string was `` (which is to say, blank), it failed to match and therefore violated the rule.

So I have a blank string that should not be blank. There is another clue, thankfully, from the name of the string type, BusinessNameControlType. Using my debugging detective skills, I infer that the string should be a business name. One possibility is that it’s the business I started late last year, Civitas. But I think it’s more likely to be one of the W-2s I received and entered manually.[1] In a few minutes I’ll look to see if I failed to enter one (or all!) of the businesses my wife and I worked for last year.

So here’s the fun part—the IRS already has those W-2 forms on file in electronic form. It probably has an easy way to index all the businesses that have been filed

W-2s using my or my wife’s Social Security Number. In fact, it’s likely the IRS has an automated audit to verify I’m reporting all my W-2s so as to ensure I’m paying taxes on all of my income. As Joy commented today when I told her I was entering my W-2s, the IRS knows everything it needs to calculate my taxes except for deductions we are eligible for and my business income.

To sum up, I got a cryptic message because I failed to enter a business name on a form the IRS already has. It’s a crazy system that could be fixed by flipping the order of operations. Instead of taxpayers submitting their tax filings and the IRS auditing some of them, the IRS could mail out what we owe and we could file corrections to account for our charitable giving and so on. My guess is that tax receipts would increase because many people would prefer to pay more than to take the time to file corrections.

One clue is a “IRSW2” string in the second paragraph of the error. ↩︎